Researching an investment property thoroughly is crucial to ensuring it’s a good financial decision. If you’re looking for a home in Port St. Joe, Mexico Beach, Cape San Blas, St. George Island, or Panama City Beach then you’ll love the information to come. Here are the steps you’ll want to take, including calculating the cap rate and return on investment (ROI):

1. Market Analysis

(Use a Realtor for help, such as the Peevy Team!)

- Local Market Trends: Research the local real estate market trends, including property values, rental rates, vacancy rates, and economic factors affecting the area. An experienced Realtor can greatly help you with this. This is an expertise of the Peevy Team.

- Neighborhood Analysis: Investigate the neighborhood’s amenities, crime rates, schools, and future development plans. Look for areas with growth potential.

2. Property Analysis

(This is also REALLY where using a Realtor helps!)

- Property Condition: Conduct a thorough inspection to assess the property’s physical condition and identify any potential repairs or renovations needed. It is highly recommended to utilize a professional home inspector for this, as well as doing your own physical inspection on site.

- Comparable Properties (Comps): Analyze similar properties in the area that have recently sold or are currently for sale to gauge the property’s value. An experienced Realtor can help you gather these numbers. The Peevy Team is happy to help with this!

- Rental Income Potential: Estimate the potential rental income based on current market rates for similar properties in the area. Consult with the property manager who manages the subject property. You can also contact multiple management companies to find a consolidated valuation of rental potential.

3. Financial Analysis

- Operating Expenses: Calculate all potential operating expenses, including property management fees, maintenance, utilities, property taxes, insurance, and any HOA fees. Your Realtor can help you gather these figures and estimates.

- Financing Costs: Include mortgage payments, interest rates, and any loan fees. Use this mortgage calculator for help https://callthepeevys.com/mortgage-calculator/

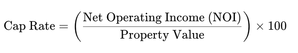

4. Calculate Cap Rate

The capitalization rate (cap rate) is a measure of the property’s ability to generate income relative to its price.

- Net Operating Income (NOI): Calculate the NOI by subtracting the annual operating expenses from the annual rental income.

- Example Calculation:

- Annual Rental Income: $50,000

- Annual Operating Expenses: $20,000

- NOI: $50,000 – $20,000 = $30,000

- Property Value: $500,000

- Cap Rate: (30,000500,000)×100=6%\left( \frac{30,000}{500,000} \right) \times 100 = 6\%

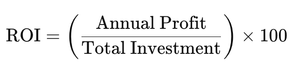

5. Calculate Return on Investment (ROI)

ROI measures the profitability of an investment.

- Annual Profit: This is typically the NOI or the net profit after financing costs.

- Total Investment: Include the property purchase price and any additional costs such as closing costs, renovations, and other fees.

- Example Calculation:

- NOI: $30,000

- Annual Mortgage Payments: $15,000

- Annual Profit: $30,000 – $15,000 = $15,000

- Total Investment: $500,000 (property price) + $20,000 (additional costs) = $520,000

- ROI: (15,000520,000)×100≈2.88%\left( \frac{15,000}{520,000} \right) \times 100 \approx 2.88\%

6. Risk Assessment

- Vacancy Rate: Account for potential vacancies and their impact on rental income.

- Market Downturns: Consider the potential impact of market downturns on property value and rental demand.

- Exit Strategy: Have a clear plan for selling or refinancing the property if needed.

7. Consult Professionals

- Real Estate Agent: Work with an experienced real estate agent who understands the local market, such as the Peevy team.

- Financial Advisor: Consult a financial advisor to ensure the investment aligns with your financial goals.

- Property Inspector: Hire a professional inspector to thoroughly assess the property’s condition.

- Attorney: Ensure all legal aspects are covered by consulting a real estate attorney.

By conducting thorough research and using these calculations, a buyer can make a more informed decision about the potential financial success of an investment property.

*Disclaimer: The information provided here is for educational purposes only and should not be construed as financial advice. Investing in real estate involves significant risk, and it’s important to conduct thorough research and due diligence. We recommend consulting with financial advisors, real estate professionals, and legal experts to ensure you make informed decisions tailored to your specific financial situation and goals.